Strange times for Netflix

Is Netflix really in trouble? Wall Street Says Yes….Subscribers have different opinions.

Streaming giant Netflix has been under a lot of scrutiny lately. In the first quarter of 2022, Netflix lost subscribers for the first time since 2011 when it began to move away from its DVD mailing roots. Since the beginning of the year, Netflix has lost 200,000 subscribers and is expecting to lose as many as 2,000,000 in the second quarter. This accelerated a drop in their stock price, which started in late 2021, causing Netflix to lose $50 billion off its market cap in the past eight months.

While they are still by far the biggest and most popular streamer, Netflix’s perception has also taken a hit outside of Wall Street. From public controversies like shutting down a slew of animation projects to supporting controversial figures like Dave Chappelle (even amidst walkouts by its own employees), they have struggled in the news cycles recently. But despite the inferno of fire and brimstone, are Netflix’s troubles really that damning?

Over the past decade, streaming has become a massive force in the entertainment landscape. In 2022, according to our latest data, 47% of respondents’ time watching entertainment was streamed while only 39% consumed it through cable. As it becomes more and more ubiquitous, and more or more young people “cut the cord,” this ratio will likely become even more unbalanced.

Netflix was the pioneer in this space, and, in the past few years, the streaming race they started gained competition from huge media conglomerates like Disney, Warner Brothers, Paramount, Amazon, and Apple. These companies have serious firepower in the form of long-established franchises and brand recognition, but, according to our data, Netflix has been more than holding its own over the past two years.

Subscriptions and Subscription Value

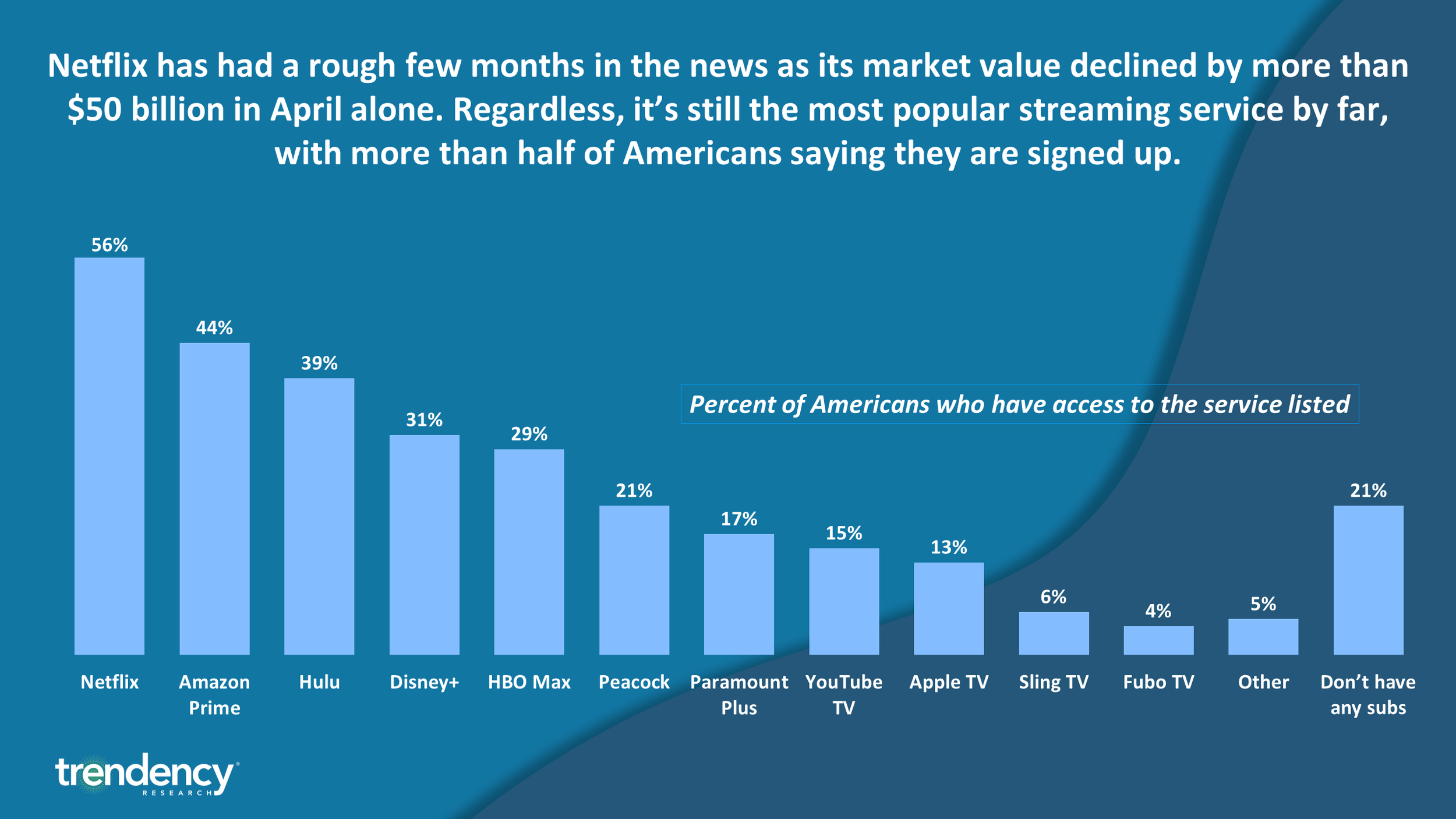

Based on our tracking of Americans nationwide, in May of 2022, 73% of Americans reported having at least one streaming subscription, with many having multiple services. Netflix was by far the most popular, with more than half of all Americans reporting having access to a Netflix subscription. The next most popular service—Amazon Prime Video—is a subset of the overall Amazon Prime service, so it is likely that many subscribers joined the program for Prime’s other features rather than as a stand-alone streaming service. Even with this built-in advantage for Amazon, Netflix still enjoys a 12-point advantage in the overall subscription rate.

When we look at our Perceived Value Scores (PVS)—a proprietary measure we developed last year using a 0-100 scale, where 100 is the highest level of satisfaction possible—Netflix also had the highest PVS of all streaming services. Again, Netflix led the pack with a score of 64.15, which was clearly separated from the next closest cohort of competitors (Hulu, Paramount+, and Amazon Prime Video), who were grouped in the second tier.

Surprisingly, Apple TV+ performed poorly in our surveys relative to what one would expect from an Apple service. Similar to Amazon, viewers of Apple TV+ are most likely subscribed only because they own an iPhone (Apple does not seem to release the breakdown of subscribers with Apple products versus outside subscribers—so this assumption could be incorrect), and should have an advantage in terms of value given the fact that it is “free” for many viewers. Apple TV+’s content offerings have some big hits—comedy series Ted Lasso being the biggest—however, they don’t have any significant legacy titles nor a particularly user-friendly app. While the Apple TV+ experience is fine, Apple is not a company known for settling for just “fine” with its products.

Looking a little deeper into the PVS for these services, we find that Netflix’s high average score is more about the lack of negative views than a clear advantage in positive views. That being said, Netflix has the highest level of subscribers who perceived its service as having a high value (80 or above), with 57% valuing it in decidedly positive terms. With the exception of Peacock and Apple TV+, a majority of subscribers to all of the services tested had a positive view of the value of their subscription. The differentiator is on the negative side of the equation where Netflix has by far the lowest concentration of subscribers who see little to no value in their subscription.

With just 5% reporting this overly negative view, Netflix has almost half the level of detractors as the next closest subscription service (Hulu with 9%), while the remaining services typically have three times the level of customers who viewed their subscription as having low or no value.

Password Sharing is the Problem….or is it?

Netflix viewers are happy, but does that mean that they are actually paying for a Netflix subscription, or are they accessing the streaming platform by other means, such as sharing a friend or family member’s password? Netflix does lag slightly when it comes to those who are currently paying for their access. Amazon Prime Video has the highest concentration of paying viewers (again, likely due to the wider Prime service), while Netflix, YouTube TV, Paramount+, Hulu, and Apple TV+ are slightly behind. We should note that we did not ask whether non-payment for these other services was due to password sharing or access through other means, such as bundles.

Over the years, Netflix has turned a blind eye toward password sharing and has been aware of this discrepancy in their subscribers; however, they recently began to point a finger at this practice as a reason for its recent stalled growth. According to their shareholder letter from the first quarter of 2022, Netflix estimates that their service is currently being shared with over 100 million non-paying households (a number made even larger compared to 222 million paying households— meaning that nearly one-third of their users are not paying for their membership). While Netflix acknowledged that the ratio of paying households to shared households has not changed much in the service’s lifetime, they now see it as an obstacle to continued growth. However, many wonder if this crackdown on password sharing will hurt Netflix more than it will help it.

According to our data, the practice of password sharing in the US is happening on a smaller scale than what Netflix is reporting overall. So, while the hit they would take by ending the ability to share passwords would see a good number of viewers walk away, it may be a smaller number than many expect (at least in the US).

Only 10% of current Netflix viewers would choose to stop watching Netflix should password sharing be eliminated. From Netflix’s perspective, losing that 10% of watchers is worth gaining the 10% who would go from password sharing to buying their own subscriptions.

Still, this crackdown is a bit worrying, as people under 45 (likely Netflix’s key demographic) and BIPOC Americans are likely to be the most affected by these changes. About 17% of people under 45 would choose to stop using Netflix should these changes come about, compared to just 4% of people 45-64 and 3% of Americans over 65. Similarly, BIPOC Americans (14%) are twice as likely to stop using Netflix should these changes take effect than white Americans (7%).

Ad-Based Netflix Option Seems Unnecessary (at least in the US)

Another solution that Netflix is considering is adding a cheaper, ad-based platform like those offered by other platforms such as Hulu, HBO Max, Paramount+, and Peacock. Despite saying for years that their platform would never feature ads, Netflix is now planning to implement an ad-based option by the end of 2022. This comes after Netflix hiked up its subscription price in early 2022. Now, the cheapest, lowest quality option (no HD viewing and only using one screen) costs $9.99 a month, more than many of Netflix’s competitors like Disney+ and Hulu. However, as shown above, this higher price tag has clearly not had any significant adverse effect on the perceived value of a Netflix subscription.

All this being said, viewers have had a wide array of responses to this announcement. About one-third of our panel would keep their current “premium” subscription, while one-quarter would switch to the cheaper option if the savings were significant, and 13% would take the cheaper option no matter how small the difference is.

Regardless of what the price actually ends up being, we asked respondents how much they think an ad-based Netflix subscription should cost. The average answer was $13.42, while the cost of an ad-free subscription price hovered around $15.50. Interestingly, only 13% of respondents believed that the ad-based service should be free, like some other services (such as Peacock) offer.

About two-thirds of respondents are looking for at least a 33% discount for an ad-based subscription, including close to 4-in-10 who would expect this kind of service to have more than a 50% discount (or free). Unexpectedly, those who give Netflix a negative PVS valued the price of the theoretical service much higher than those who give Netflix a positive score ($19.09 vs. $15.27). Those who are more indifferent to the value of Netflix gave the highest average price ($12.84) for an ad-based subscription.

Interestingly, the more a person streams, the less they tend to think an ad-based Netflix service should cost. This data still has more surprises, however, as those who stream 0% of the time instead of viewing via a cable subscription and those who stream 100% of the time both value an ad-based Netflix service between $9 and $10.

Netflix is Viewed as the Most Innovative Streaming Company

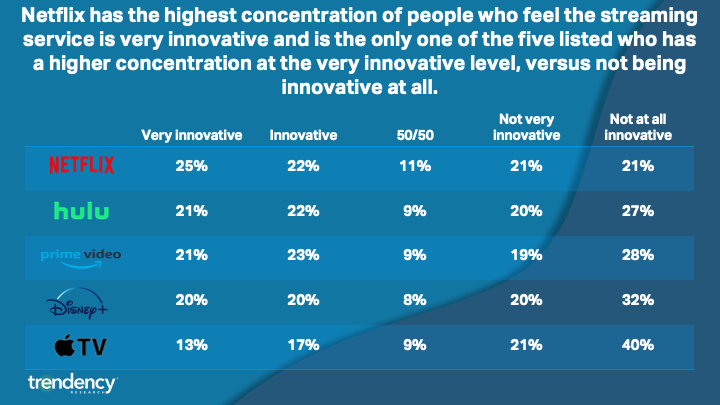

Controversies around pricing and password sharing aside, Netflix continues to be viewed as the most innovative service in the streaming war. As the first major service to create original streaming content, Netflix has paved the way for current popular original series like Disney+’s The Mandalorian, HBO Max’s Peacemaker, Apple TV+’s Ted Lasso, and Amazon Prime’s upcoming Lord of the Rings: The Rings of Power. A total of 47% of all people view Netflix as being innovative, as opposed to 42% who hold the opposite view. Netflix is the only service measured that has a higher concentration of “innovative” scores than “not innovative.”

Amongst subscribers, Netflix is still seen as the most innovative, though its advantage shrinks. Disney+ had a significant jump when measuring all people to only subscribers. Perhaps subscribers are recognizing some of the technical breakthroughs Disney+ has made on series like The Mandalorian, which are beginning to be adapted into other movies and television shows. Still, people see Netflix as the most innovative. Perhaps they are seen as innovative for paving the way for streaming originals in the early 2010s or for their continued desire to tell new stories rather than relying on long-existing franchises like many other studios have been for their streaming content.

Despite many of its early hit shows like Orange Is the New Black ending in recent years and even a few, like Daredevil, moving to other services, Netflix originals are still widely successful. Netflix still has many hit shows, with 2021’s Squid Game being the service’s biggest show of all time, as well as favorites like Stranger Things, The Witcher, and Bridgerton, all of which have released new, successful seasons in the past year.

In 2022, Netflix continues to experiment with new projects as well, including the LGBTQ+-friendly hit Heartstopper and the Ryan Reynolds-led time travel film The Adam Project. Despite losing many big legacy titles, like The Office or Friends, to other services, licensed properties like IT, Sing 2, and James Cameron’s Titanic still dominate the top ten on Netflix as of June 2022.

Conclusion

Despite its recent struggles, Netflix remains a juggernaut in the streaming landscape. They are still the most popular service in the public consciousness, seen as having the most value and seen as the most innovative. Although they have experienced some losses as the streaming race has grown more competitive, Netflix is still the top dog in the streaming world.

While Wall Street has taken a decidedly negative view of the organization, subscribers' value of Netflix differs from what investors are willing to pay. With over 200 million subscribers worldwide, Netflix is taking in roughly $2.6 billion dollars a month and is viewed as the most innovative streaming company, all while having the highest perceived value among its subscribers. Despite predictions of Netflix’s death, it might be a little early to be writing its obituary.