Is Streaming’s Dominance Over? No, Not Even Close.

As more and more streaming platforms appear on the market and consumer choice increases, individual platforms such as Netflix have been losing content to which they previously had streaming rights. This has sparked a debate around the decreasing value of certain streaming services. However, in 2023, the streaming industry's dominance has further escalated that of cable television, while, in 2022, there was only an 8-point difference in time spent viewing entertainment in favor of streaming, this value has nearly tripled as of 2023. Americans now spend an average of over half of their time watching streaming while spending less than a third of their time watching cable.

The past year has also seen a growth in people who stream 90% of the time or more. While this group represented a quarter of all respondents in 2022, it now represents a third of Americans. On the other hand, all groups that spent 50% or less of their time streaming decreased, without exception. While half of Americans used to spend less than 50% of their time streaming in 2022, this figure dropped 6 points in 2023. College-educated women and those aged from 18 to 29 are the most likely groups to spend a high majority of their time streaming.

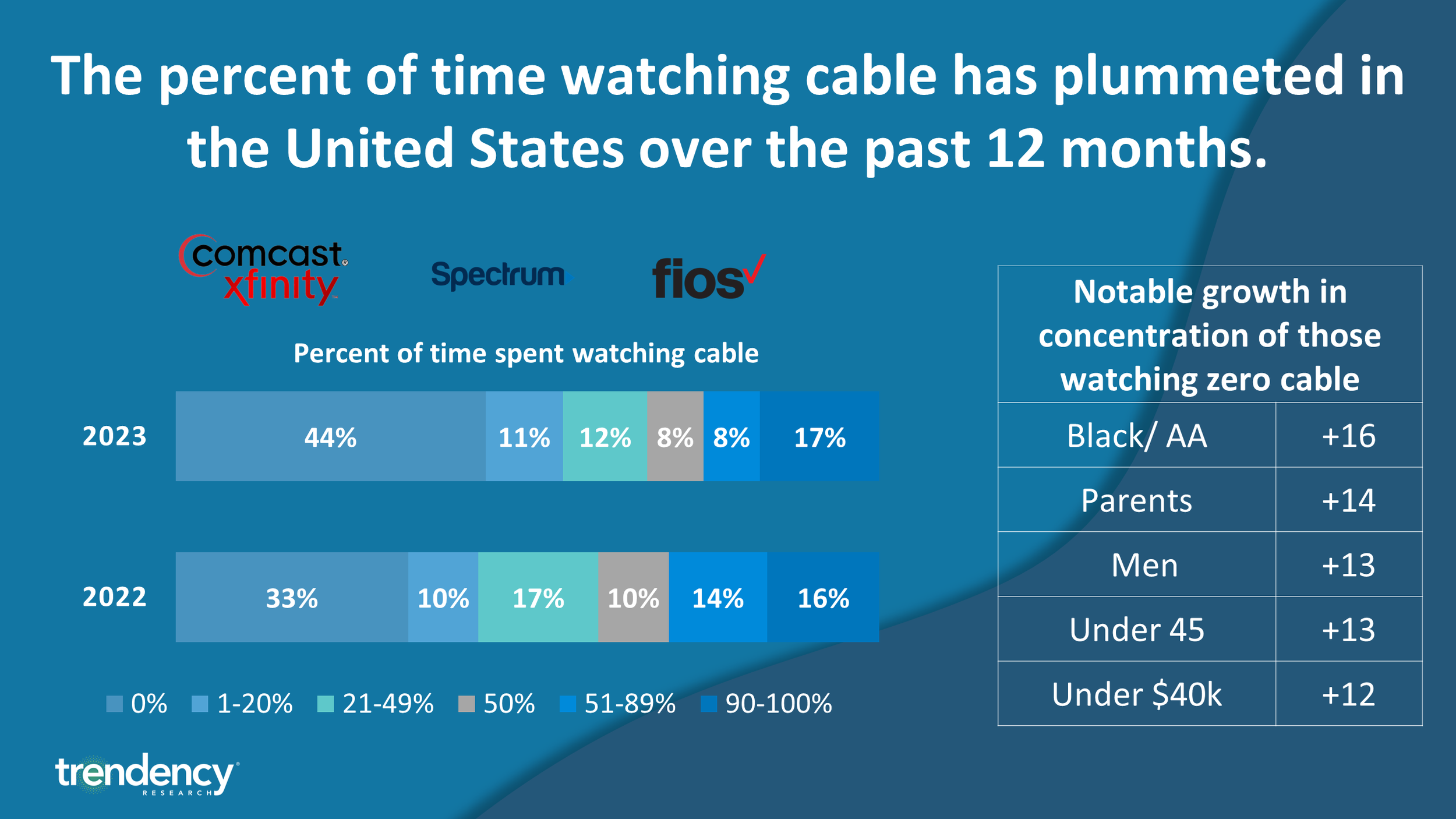

The trend observed for those who watch cable television is inverse to that of streaming, meaning that the percentage of time spent on it has heavily decreased in the past year. Indeed, the rate of Americans who do not watch cable at all has increased by a third compared to 2022. This means that a quarter of Americans who do not watch cable in 2023 used to do so in 2022. The groups with the most notable concentration of people who do not watch any cable TV are black and African Americans, with a sixth claiming that they had not spent any time streaming cable.

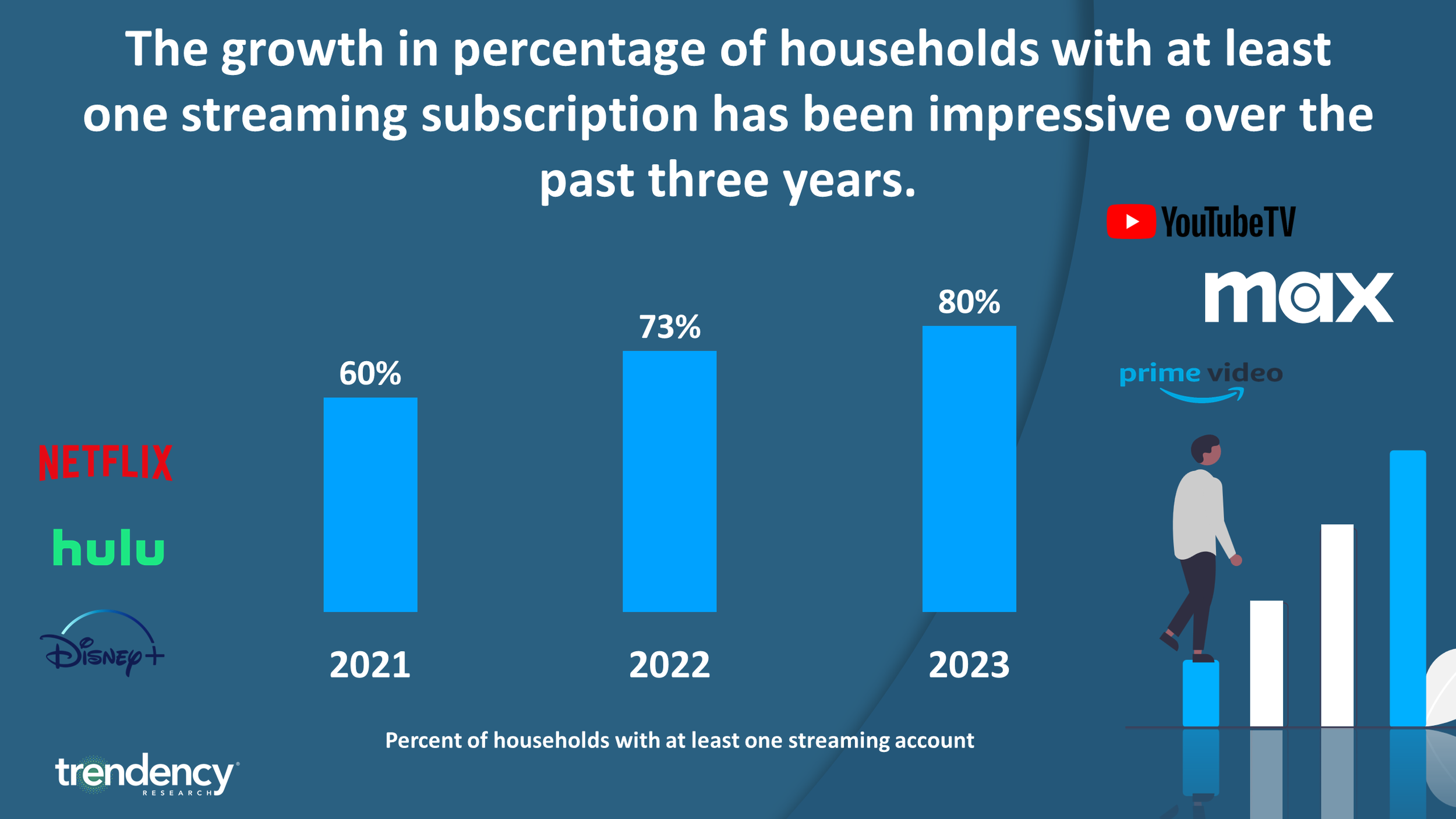

There has been a notable growth in households that had at least one subscription to a streaming service in the past three years. While 60% of households had access to at least one streaming service in 2021, 80% subscribed to at least one of them in 2023. This means that a quarter of Americans who had at least one subscription in 2023 did not have access to online streaming services just two years ago. However, it should be noted that the increase in subscriptions to streaming services is slightly lower this year than last year, which could signal the saturation of streaming over the next years within the entertainment market in America.

Between 2021 and 2022, there has been an increase in the percentage of parents with access to a streaming subscription. These numbers stagnated between 2022 and 2023, but parents continue to dominate the overall concentration of the market. However, it is interesting to note the continuous increase in subscriber rates among non-parents. In 2023, they increased by six points, while in the past two years, these rates went from just above half of Americans to three out of four Americans. Similarly to previous observations, the overall growth in new subscribers, regardless of their parental status, has slowed down this year.

This trend can also be observed among Americans over the age of 65. In 2021, 43% of seniors reported having a subscription. This number rose sharply to 56% in 2022, increasing by 13 points. In 2023, this number only rose by 5 points, reaching 61%. When it comes to Americans that are under 45, a similar trend to that of parents can be observed. Indeed, numbers skyrocketed from 72% to 90% of them having access to a streaming subscription from 2021 to 2023. However, those under 45’s subscription rate stagnated at 90% in 2023.

Slow growth can also be observed within income groups. However, between lower and higher income groups, the growth rates were relatively similar each year. Between 2021 and 2022, both groups had a 25% increase in subscription rates, and between 2022 and 2023, both also had a 4-5% increase in subscriptions. Therefore, the trends for subscription to streaming services do not vary much depending on income group. However, those who belong to higher income categories do have higher overall subscription rates. As of 2023, 89% of those who earned over $80K a year had a streaming subscription while only 75% of those earning under $40K a year had access to a streaming service.

Overall, streaming services continue to outperform cable at important rates, indicating that the replacement of cable by streaming services as a preferred source of entertainment is still on the rise. However, this corresponds to the time spent on these services and not on subscription rates.

When analyzing different demographic groups’ subscription rates, there are indeed slight disparities over the rates of subscription depending on socioeconomic factors, but the subscription trends are overall similar. Compared to the previous year, the growth of subscription rates has slowed down. Depending on the group studied, subscription rates have risen but less than in 2022, or they have completely stagnated.

What should be observed in the future is whether the pattern will persist, with subscription growth rates progressively slowing until the streaming service market becomes saturated across all demographic segments. Additionally, it remains to be seen if streaming platforms will be able to meet investors' anticipations for annual revenue growth without necessitating additional hikes in subscription costs.